portability estate tax exemption

If the gift or estate includes property the value of the property is. For instance the Tax Cuts and Jobs Act TCJA doubled the estate tax exemption amount.

Tax Related Estate Planning Lee Kiefer Park

It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their wishes.

. Each year the federal estate tax increases as it is indexed for inflation. This post will discuss the general rules of portability. Portability also applies to gift tax and therefore the gift tax exemption is also 16880000 for the survivor.

If the estate needs more time to file for portability they can apply for a 6-month extension. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for Illinois. Portabilitys Effect on Tax-Efficient Estate Tax Planning.

As your planning goals or assets change so too should your estate planning change. Using the concept of portability of the estate tax exemption between spouses under these facts Franks unused 5340000 estate tax exemption will be added to Jennifers 5340000 exemption in turn giving Jennifer a 10500000 exemption. Subscribe And Save More At CPA Self Study Online.

For 2019 the exemption sat at 114 million. This is the amount a person can leave their heirs without paying federal estate taxes and which is annually indexed for inflation. By working together your planning team can ensure.

When filing the taxes its important to select the portability election to have the benefits transferred to. In 2021 this amount was 15000 and in 2022 this amount is 16000. This means that the exemption moved up to 1118 million per person for the years 2018 through 2025.

If during hisher lifetime the survivor. Each California resident may gift a certain amount of property in a given tax year tax-free. For decedents dying in 2011 and 2012 the personal representative can elect to transfer the deceased spouses unused exemption to his or her surviving spouse.

The surviving spouse can use the unused portion of the predeceased spouses estate and gift tax exemption. This was just the estate tax portability rules though. Secondly it only applies to the federal estate tax exemption.

The Tax Cuts and Jobs Act increased the federal estate tax exemption in 2018 and it has increased since then adjusting with inflation so its no surprise that the exemption is higher for 2022. Learn With CPA Self Study. Please note these laws being permanent means that they are not set.

In order to benefit from this exemption however the surviving spouse must file IRS Form 706 the United States Estate and Generation-Skipping Transfer tax return within nine months of the first death in order to elect portability. Currently the federal estate tax exemption is 11400000 per spouse. In recent years there have been several significant pieces of legislation relating to the federal estate tax exemption.

Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. However that exemption is scheduled to return to 5000000 as adjusted for inflation in 2026. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax.

As of that time the estate tax exemption was much lower. 247 Access To More Than 130 Courses. Dont leave your 500K legacy to the government.

The key advantage of portability is flexibility. Portability of the federal estate tax is an improvement of the default Congressional estate plan but it is not a substitute for proper planning or continuous updating of existing planning. Ad Practical And Affordable CPE Courses For CPAs.

For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per person. There are only two states Hawaii and Maryland that have provisions for state estate tax portability as of 2020. Prior to the enactment of the portability law in 2010 most estate plans for married couples set aside at the first.

The Illinois estate tax on an estate of 16880000 would be 1524400. Get your free copy of The 15-Minute Financial Plan from Fisher Investments. And then after one spouses death then the surviving spouse can take steps to combine their estate tax exemptions to reduce estate tax.

Ad Get free estate planning strategies. Portability of the estate tax exemption The American Tax Relief Act of 2012 ATRA signed into law on January 3 2013 by President Obama extended the opportunities for portability of a decedents unused estate tax exemption. Still theres a good chance many South Florida homeowners will see an increase in their tax bill the year after they bought their homes.

When the surviving spouse later dies or makes a lifetime gift the surviving spouse will have his or her own. NBC 6 took a look at a random home in Miramar that was. Currently the amount exempt from gift estate and generation skipping transfer tax is 5430000 per person.

The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. A limited amount of a persons wealth can be transferred to his or her loved-ones free from gift estate and generation skipping transfer tax. In 2016 it increases to 5450000 per person.

Portability of the Estate Tax Exemption. Historical Estate Tax Exemption Amounts And Tax Rates 2022 In addition going forward any executor will automatically have until the second. Enter portability of the estate tax exemption.

In 2010 it increased to 1158 million.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

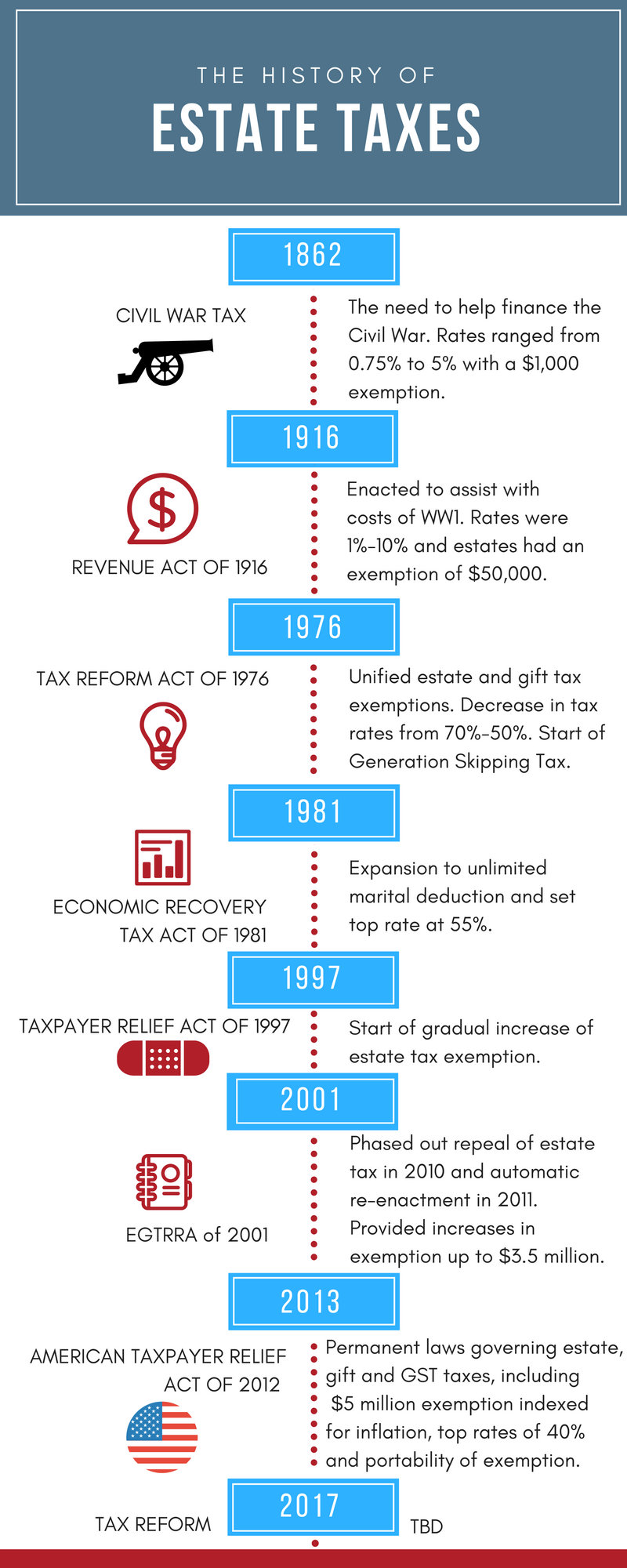

A Brief History Of Estate Gift Taxes

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

New Estate Tax Laws For 2021 Youtube

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

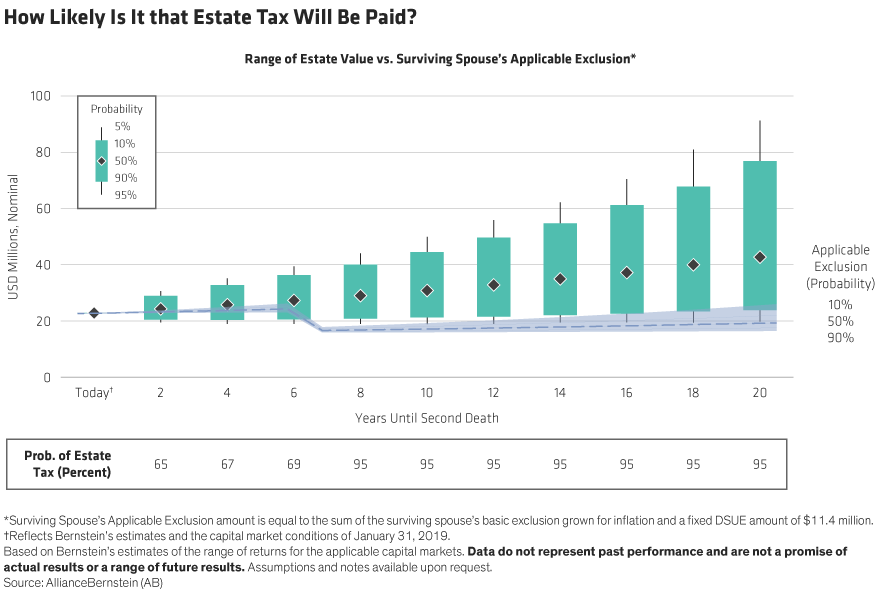

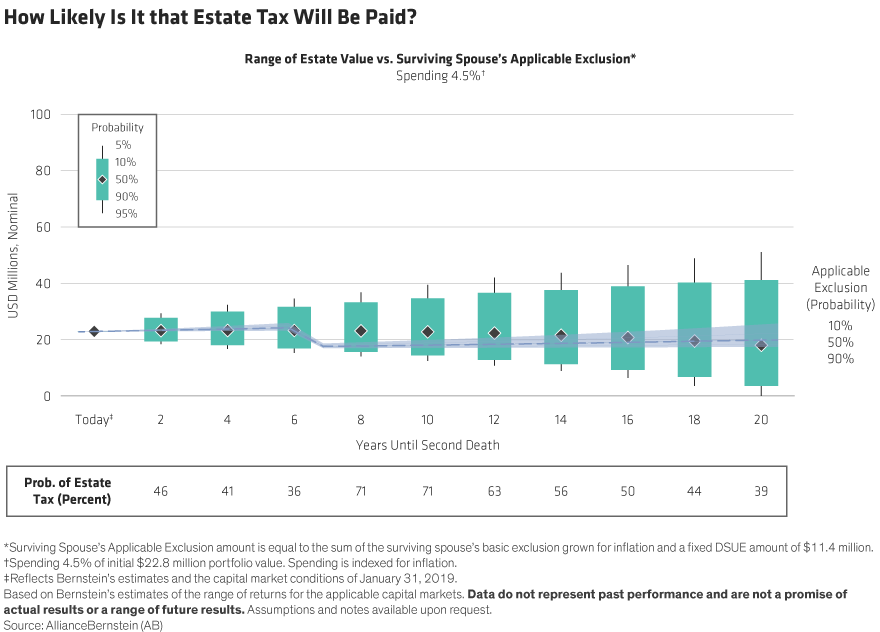

Will Your Estate Be Taxable In The Future Context Ab

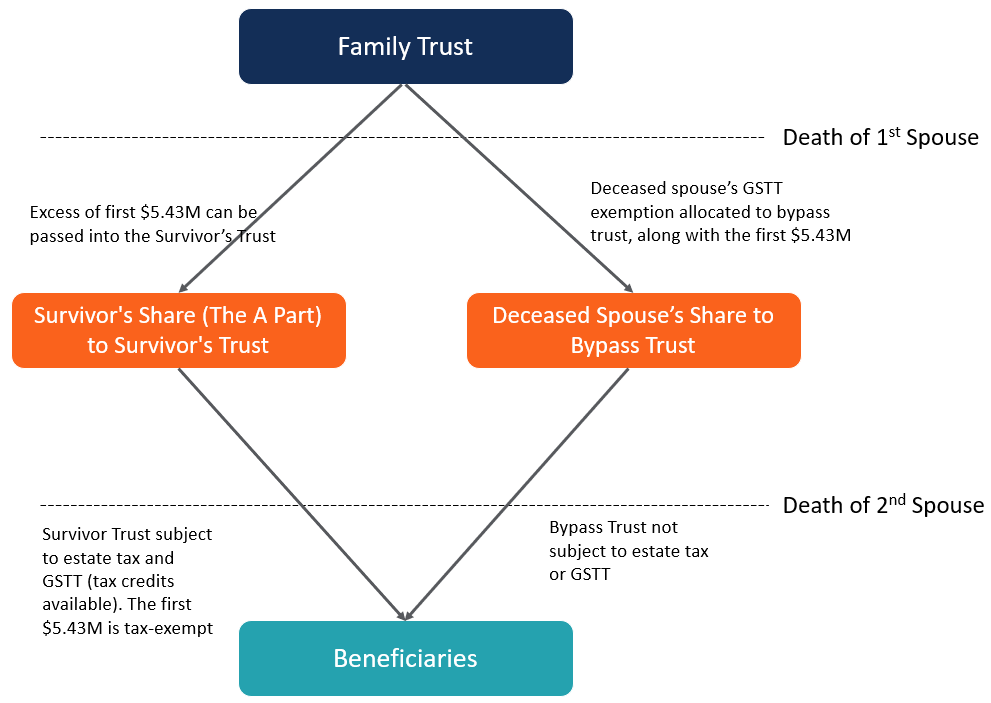

Understanding Qualified Domestic Trusts And Portability

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Your Beloved Spouse Just Died How To Deal With The Estate Tax

Is Ab Trust Planning Still Effective

A B Trust Overview Purpose How It Works Advantages

Estate Tax Introduction Video Taxes Khan Academy

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Unemployment Debit Cards Work And How To Avoid Being Scammed Amazon Gift Card Free Visa Card Best Credit Cards

Drafting In Uncertain Times Womble Bond Dickinson

Exploring The Estate Tax Part 2 Journal Of Accountancy

Will Your Estate Be Taxable In The Future Context Ab

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information